Artical comes from the website: https://batteriesnews.com/lithium-energy-graphite-facility-australia-battery-market/

Lithium Energy considering graphite facility in Australia for the battery market.

Australian battery metals company Lithium Energy is poised to take on China by launching plans to become one of the few Purified Spherical Graphite (PSG) producers outside the Asian nation.

PSG is a form of graphite specifically designed for the growing lithium-ion battery anode market, and is expected to see an incredible 10-fold increase in demand over the next decade.

Lithium Energy’s (ASX:LEL) ace in the hole is its Burke Graphite Project in Queensland, which contains one of the highest grade graphite resources in the world.

Rather than just dig it up and ship the product overseas as a concentrate, Lithium Energy wants to capture the full value of that asset by becoming a downstream producer of PSG.

That would make it one of the few manufacturers outside China, which has a virtual monopoly on a market it supplies through highly toxic chemical processes.

For battery producers and electric vehicle makers concerned about supply chain security and ESG, that makes alternative sources of the battery material attractive.

“Battery manufacturers are therefore increasingly seeking alternative sources for graphite,” Lithium Energy said.

“Australia is well positioned to meet this demand, with strong technical capabilities together with a range of government funded initiatives such as the Future Battery Industries Cooperative Research Centre (CRC) which actively support the value enhancement of local critical minerals, including graphite.”

Burke grade and location stands out

Lithium Energy boasts one of the highest grade graphite resources in the world at Burke, located near Cloncurry in Queensland’s mining heartland.

At 6.3Mt at 16% true graphitic carbon (1Mt of contained graphite), with a higher grade zone of 2.3Mt at 20.6% TGC (464,000t of Total Graphitic Carbon), Burke has grades that make it a perfect feedstock for battery-grade graphite products.

That location is important as well since it is located close to the North Queensland Townsville Energy Chemicals Hub, which has been unveiled as a centre for refining metals for battery production.

It is not the only graphite deposit in the region, with Novonix’s Dromedary project also nearby.

That indicates the prospectivity of the region for further graphite supplies and reserves.

Burke’s location would provide transport savings compared with manufacturing operations that are required to import graphite as a bulk commodity from overseas mines.

Test work to date with the CSIRO, Australia’s chief science body, has supported Lithium Energy’s conviction its product is suited to the lithium-ion battery market.

It is a little-known fact that there is 10 times as much graphite as lithium by weight in a lithium-ion battery.

“Test work undertaken by CSIRO has been highly encouraging of the suitability of Burke graphite for use in lithium-ion batteries,” Lithium Energy said.

“The company continues to work with CSIRO to test and optimise the processes used for purification and spheronisation of its Burke graphite which works will flow into and help finalise processing plant design.”

Next steps

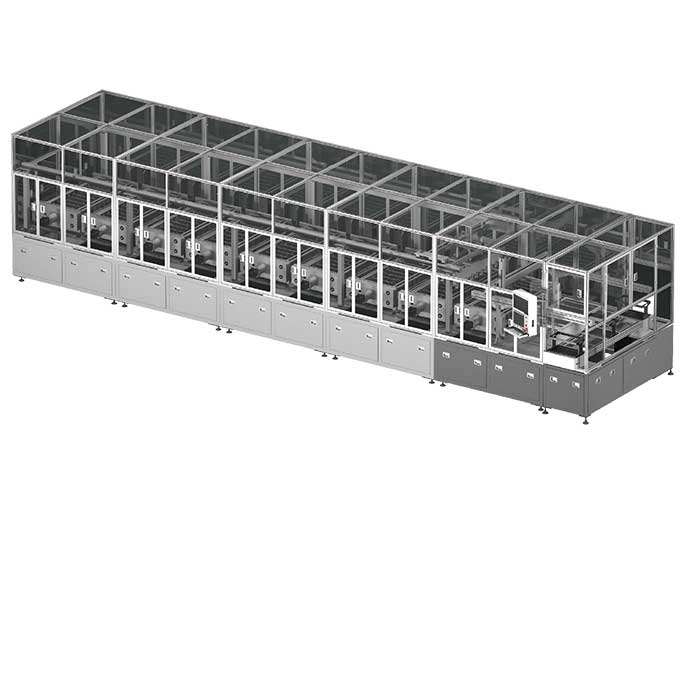

Lithium Energy has laid out a comprehensive order of milestones to back its investigations into the establishment of a dedicated, environmentally sustainable manufacturing facility to purify and spheronise graphite sourced from its high-grade Burke graphite deposit.

That pathway will include:

- Appointment of lead engineering company(ies) to assist with project studies

- Choosing a location

- Completion of current CSIRO test work and the engagement with regional government agencies

- Finalisation of process flow sheet upon completion of test work and selection of underlying processing methodology

- Upgrading the current JORC Mineral Resource to an Ore Reserve status

- Conversion of the Burke tenement to a Mining Lease

- Construction of Pilot Plant

- Initial Production from Burke Deposit to Pilot Plant

- Finalisation of Plant Design based upon Pilot Plant data

- Finalisation of Processing Plant Design

- Completion of all required studies and permitting

- Receipt of Project Finance and Final Investment Decision.

The explorer is up around 100% since its May listing, rising 8% to 73c this morning on the announcement of its graphite processing plans.

日本語

日本語